NOT FOR DISTRIBUTION TO UNITED STATES NEWSWIRE SERVICES OR FOR DISSEMINATION IN THE UNITED STATES

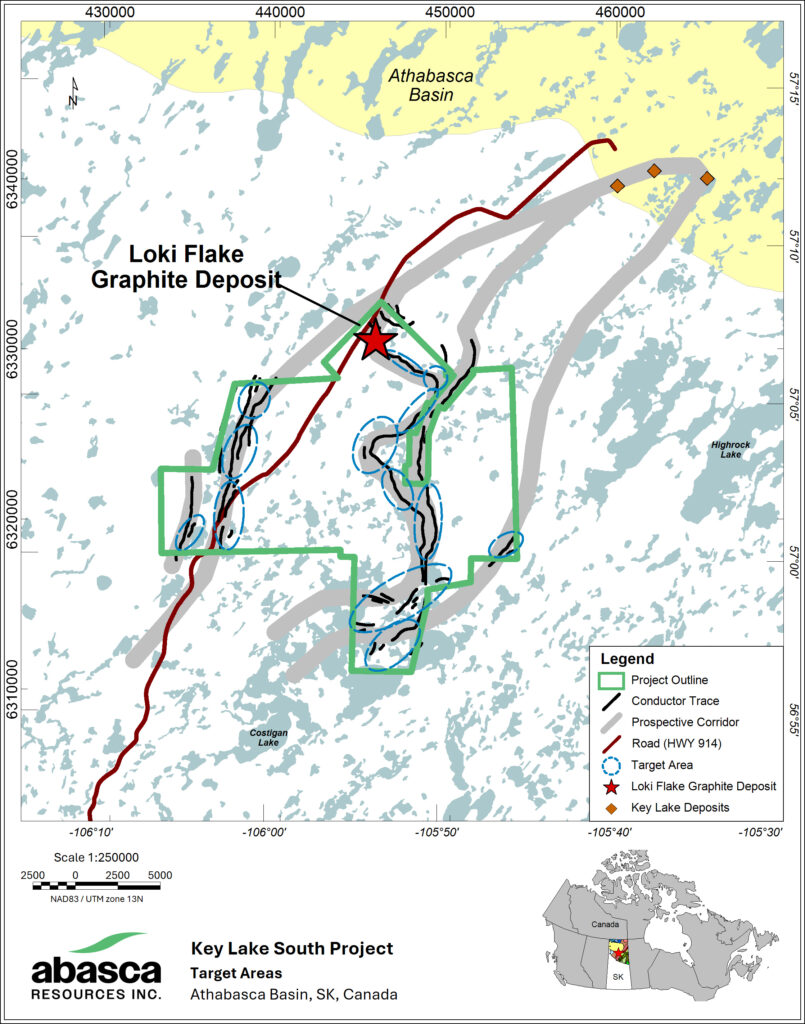

April 22, 2025 – Saskatoon, Saskatchewan: Abasca Resources Inc. (“Abasca” or the “Company”) (TSX V: ABA) is pleased to announce the completion of its 2025 Winter Program at its 100% owned Key Lake South Project (KLS; Table 1, Figure 1). The program consisted of 5,925 m of drilling that was focused on drilling the northwest and southeast extensions of the Loki Flake Graphite Deposit (the “Loki Deposit” (see Figure 2)) as well as to the north of the Loki Deposit.

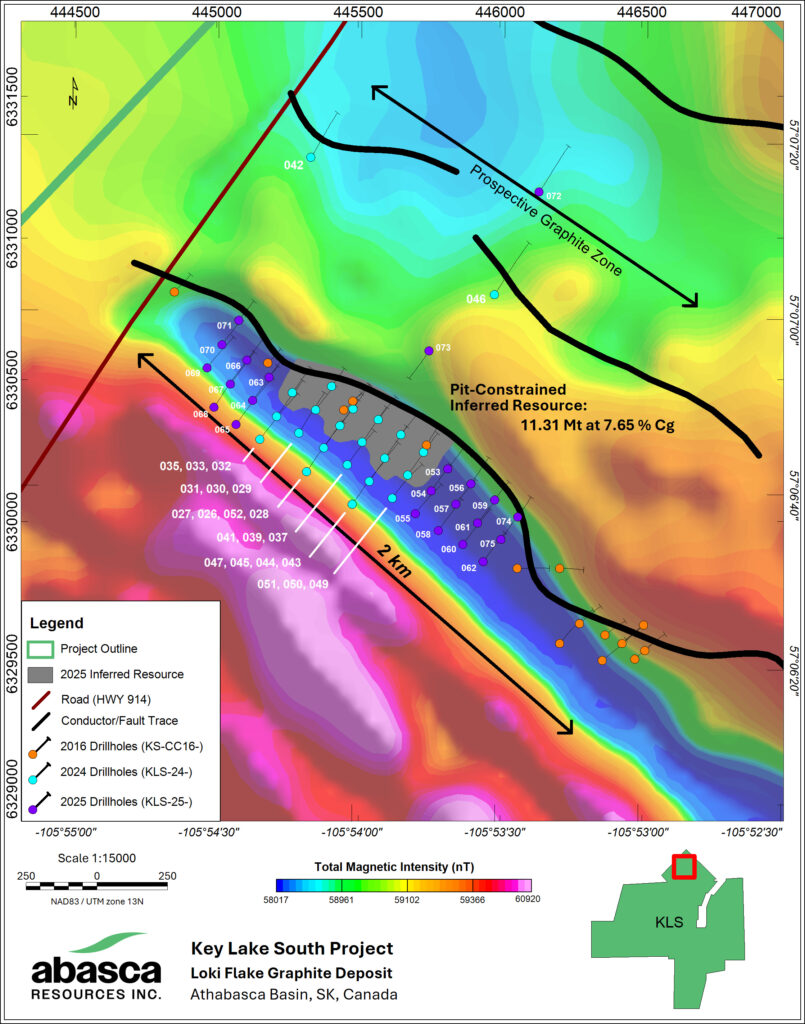

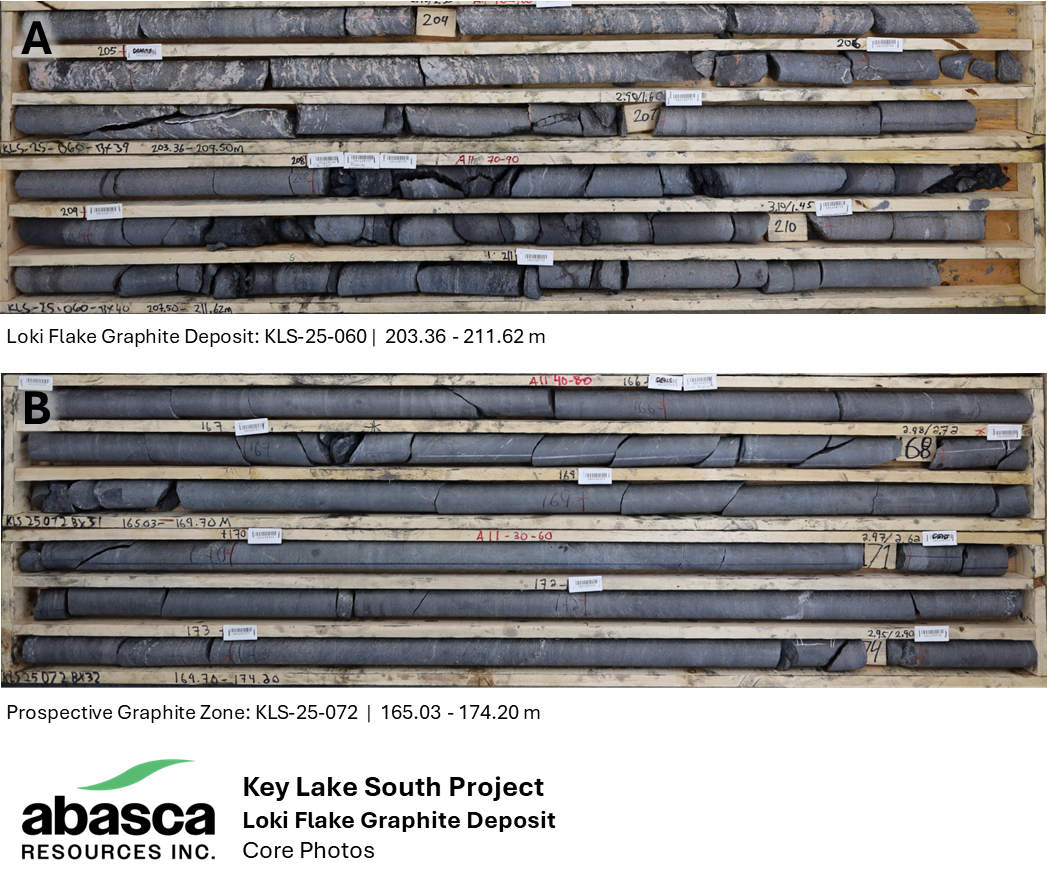

Extensional drilling at the Loki Deposit continued at a 100 m x 100 m grid spacing, similar to the 2024 summer program. Drilling continued to intersect strong graphite mineralization along the trend in multiple holes, confirming the extension along the trend between the 2016 drill holes (Figure 3A).

One drill hole (KLS-24-072) was completed along the prospective zone north and parallel to the Loki Deposit (Figure 2). Multiple graphite intersections, up to 45 m in length, were encountered within the hole and the graphite mineralization is visually similar to the Loki Deposit (Figure 3B). The drilling was designed to investigate the graphite mineralization up-dip of that intersected in the summer of 2024 (for details about the 2024 drilling, see the Company’s news release dated November 27th, 2024).

Brian McEwan, Vice-President of Exploration, stated, “We had another successful drill program at the Loki Flake Graphite Deposit this winter. We continued to have strong intersections of graphite mineralization alongside our 2024 drilling as we build outward. It’s also very exciting to see the prospective northern trend yield more significant intersections of graphite at similar shallow depths like at the Loki Deposit. The results are really positive on the back of the 11.31 Mt inferred resource estimate at the Loki Flake Graphite Deposit that we announced on April 15th, 2025.”

The Company is also announcing a non-brokered private placement (the “Private Placement”) of $1.25 million which would be comprised of the sale of up to 6,250,000 units of the Company (the “FT Units”) at a price of $0.16 per FT Unit and the sale of up to 1,785,715 non-flow-through units of the Company (the “NFT Units”) at a price of $0.14 per NFT Unit. Each FT Unit is to be comprised of one common share of the Company (a “FT Share” and each common share of the Company, a “Common Share”) to be issued as a “flow-through share” (as defined in the Income Tax Act (Canada) (the “Tax Act”)) and one-half of a Common Share purchase warrant (each whole warrant, a “Warrant”), with each Warrant entitling the holder to purchase an additional Common Share (a “Warrant Share”) for a period of two years at a price of $0.20 per Warrant Share. Each NFT Unit is to be comprised of one Common Share and one-half of a Warrant.

The gross proceeds received from the Private Placement will be used for exploration activities on the Company’s Key Lake South Project (KLS), including the commencement of environmental baseline and hydrological studies, working capital, and for other general and administrative costs. The gross proceeds from the issuance of the FT Shares are intended to be used to incur “Canadian exploration expenses” (as this term is defined in the Tax Act) that the Company may renounce pursuant to the Tax Act as “flow-through mining expenditures” (as this term is defined in the Tax Act) or, if the Company determines in its sole discretion, as “flow-through critical mineral mining expenditures” (as defined in the Tax Act).

In connection with the Private Placement, the Company may pay cash finder’s fees equal up to 6.0% of the gross proceeds raised from Investors introduced to the Company by finders (“Finders”) and issue Warrants equal up to 6.0% of the number of Units acquired by Investors introduced to the Company by Finders in accordance with the policies of the Exchange. All securities issued and sold under the Private Placement will be subject to a hold period expiring four months and one day from the date of closing of the Private Placement. Closing of the Private Placement is subject to the Company’s receipt of Exchange approval.

Table 1: 2025 winter drillhole locations and total lengths (UTM NAD83, Zone 12N).

| Drillhole ID | Easting | Northing | Elevation | Azimuth | Inclination | EOH |

| KLS-25-053 | 445815 | 6330186 | 558 | 35 | -60 | 197 |

| KLS-25-054 | 445757 | 6330108 | 556 | 35 | -60 | 247 |

| KLS-25-055 | 445701 | 6330028 | 551 | 35 | -60 | 284 |

| KLS-25-056 | 445897 | 6330133 | 550 | 35 | -60 | 233 |

| KLS-25-057 | 445844 | 6330061 | 550 | 35 | -60 | 230 |

| KLS-25-058 | 445782 | 6329968 | 548 | 35 | -60 | 296 |

| KLS-25-059 | 445981 | 6330077 | 551 | 35 | -60 | 165 |

| KLS-25-060 | 445868 | 6329920 | 544 | 35 | -60 | 315 |

| KLS-25-061 | 445920 | 6329995 | 544 | 35 | -60 | 222 |

| KLS-25-062 | 445940 | 6329859 | 543 | 35 | -60 | 261 |

| KLS-25-063 | 445185 | 6330509 | 547 | 35 | -60 | 171 |

| KLS-25-064 | 445126 | 6330427 | 548 | 35 | -60 | 289 |

| KLS-25-065 | 445068 | 6330343 | 549 | 35 | -60 | 403 |

| KLS-25-066 | 445106 | 6330570 | 542 | 35 | -60 | 187 |

| KLS-25-067 | 445048 | 6330485 | 545 | 35 | -60 | 272 |

| KLS-25-068 | 444990 | 6330404 | 545 | 35 | -60 | 394 |

| KLS-25-069 | 444966 | 6330542 | 552 | 35 | -60 | 291 |

| KLS-25-070 | 445018 | 6330624 | 549 | 35 | -60 | 227 |

| KLS-25-071 | 445078 | 6330710 | 552 | 35 | -60 | 171 |

| KLS-25-072 | 446137 | 6331163 | 536 | 35 | -60 | 429 |

| KLS-25-073 | 445749 | 6330602 | 553 | 215 | -60 | 248 |

| KLS-25-074 | 446062 | 6330016 | 547 | 35 | -60 | 172 |

| KLS-25-075 | 446003 | 6329937 | 543 | 35 | -60 | 221 |

For more information on the Loki Flake Graphite Deposit and an overview of the Key Lake South Project, please visit the Company’s website at https://www.abasca.ca.

Figure 1: Map of the Key Lake South Project area showing the location of the Loki Flake Graphite Deposit in and the priority target areas for uranium exploration along prospective graphitic corridors.

Figure 2: Map of the Loki Flake Graphite Deposit area showing the 2025 winter drilling that focused on delineating the extension of the Loki Flake Graphite Deposit. Note that KLS-25-072 tested the parallel prospective graphite zone to the north of the Loki Deposit.

Figure 3: Core photos from the 2025 winter drill program at the Key Lake South Project. A) Graphite mineralization from KLS-25-060 (full intersection not shown), 300 m along-strike toward the southeast of the 2024 summer drilling that defined the Loki Flake Graphite Deposit. B) Strong graphite mineralization from a 45 m intersection within KLS-25-072, drilled toward a parallel conductor north of the Loki Deposit.

Qualified Person

The technical information in this news release has been reviewed and approved by Brian McEwan, P.Geo, a Qualified Person as set out in National Instrument 43-101 – Standards of Disclosure for Mineral Projects. Mr. McEwan is the Vice-President of Exploration at Abasca.

About Abasca Resources Inc.

Abasca is a mineral exploration company that is primarily engaged in the acquisition and evaluation of mineral exploration properties. The Company owns the Key Lake South Project (KLS), a 23,977-hectare exploration project located in the Athabasca Basin Region in northern Saskatchewan, approximately 15 km south of the former Key Lake mine and current Key Lake mill. The project possesses geological similarities and along strike of past Key Lake Mine with prospective conductors of over 50 km for potential uranium mineralization. KLS is also host to the Loki Flake Graphite Deposit comprising a total inferred resource of 11.31 Mt at 7.65 % Cg. Please refer to the Company’s news release dated April 15, 2025 for further information about the resource estimate.

On Behalf of Abasca Resources Inc.

Dawn Zhou, M.Sc, CPA, CGA

President, CEO and Director

For more information visit the Company’s website at https://www.abasca.ca or contact:

Abasca Resources Inc.

Email: [email protected]

Telephone: +1 (306) 933 4261

Neither the TSX Venture Exchange Inc. nor its Regulation Service Provider (as that term is defined in the policies of the TSX Venture Exchange Inc.) accepts responsibility for the adequacy or accuracy of this press release.

This news release does not constitute an offer to sell or a solicitation of an offer to buy any of the securities in the United States of America. The securities have not been and will not be registered under the United States Securities Act of 1933 (the “1933 Act”) or any state securities laws and may not be offered or sold within the United States or to U.S. Persons (as defined in the 1933 Act) unless registered under the 1933 Act and applicable state securities laws, or an exemption from such registration is available.

Forward-Looking Information

This press release may contain certain forward-looking information and statements (“forward-looking information”) within the meaning of applicable Canadian securities legislation that are not based on historical fact, including without limitation statements containing the words “believes”, “anticipates”, “plans”, “intends”, “will”, “should”, “expects”, “continue”, “estimate”, “forecasts” and other similar expressions. Forward-looking information reflects management’s current beliefs with respect to future events and is based on information currently available to management. Forward-looking information contained in this press release includes, but is not limited to, statements relating to the mineral resource estimate for the Loki Deposit. Readers are cautioned to not place undue reliance on forward-looking information. Actual results and developments may differ materially from those contemplated by these statements. Abasca undertakes no obligation to comment on analyses, expectations, or statements made by third-parties in respect of Abasca, its securities, or financial or operating results (as applicable). Although Abasca believes that the expectations reflected in forward-looking information in this press release are reasonable, such forward-looking information has been based on expectations, factors, and assumptions concerning future events which may prove to be inaccurate and are subject to numerous risks, uncertainties and factors, certain of which are beyond Abasca’s control, including the impact of general business and economic conditions; risks related the exploration activities to be conducted on KLS, including risks related to government and environmental regulation; actual results of exploration activities; industry conditions, including uranium and graphite price fluctuations, interest and exchange rate fluctuations; the influence of macroeconomic developments; business opportunities that become available or are pursued; title, permit or license disputes related to KLS; litigation; fluctuations in interest rates; and other factors. In addition, the forward-looking information is based on several assumptions which may prove to be incorrect, including, but not limited to, assumptions about the availability of qualified employees and contractors for the Company’s operations and the availability of equipment. The forward-looking information contained in this press release are expressly qualified by this cautionary statement and are made as of the date hereof. Abasca disclaims any intention and has no obligation or responsibility, except as required by law, to update or revise any forward-looking information, whether as a result of new information, future events or otherwise.